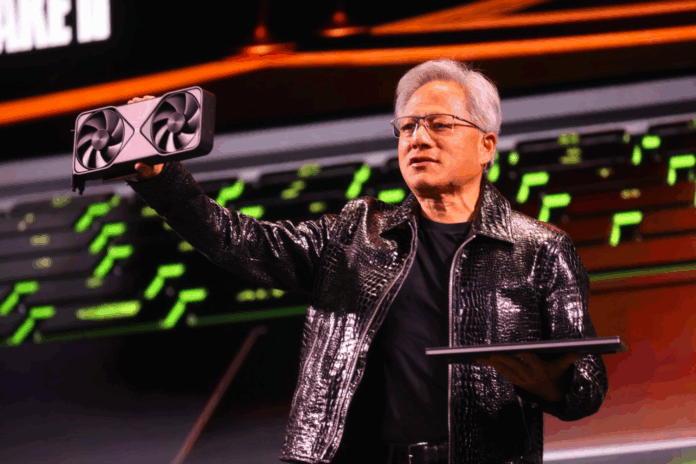

It doesn’t get much more of a luxury problem than this: an anecdote from Jensen Huang once again highlights how far Nvidia has come thanks to AI.

In an interview at the World Economic Forum, Nvidia CEO Jensen Huang talks about a car purchase he now regrets. It was about 26 years ago.

- When the company went public in 1999, he sold shares in Nvidia to buy his parents a Mercedes S-Class.

- According to Huang, the company was worth around $300 million at the time; today, in the wake of the AI boom, it is worth over $4.4 trillion. The value of a share has risen from $12 at the time of the IPO to around $183 today.

- There are other important factors to consider, such as the six stock splits that Nvidia has carried out since then (significantly increasing the number of shares) and the dividends paid out over time. In other words, Huang’s sold shares would be worth significantly more today.

In the video below, Nvidia’s CEO jokingly refers to his parents’ Mercedes as the most expensive car in the world

. His parents still own the car.

Amusing side note: Huang’s interview partner Laurence D. Fink (CEO of BlackRock, the world’s largest asset management company) always mispronounces Nvidia

(nuh-wi-di-a

instead of en-wi-di-a

).

An impressive calculation

In 1999, a Mercedes S-Class cost between $70,000 and $140,000.

If you had bought $70,000 worth of Nvidia shares when the company went public, you would be incredibly wealthy today.

- The initial price of $12 corresponds to approximately 5,833 shares at $70,000.

- The six stock splits since 1999 bring the number of shares to almost 2,800,000.

- At a current price of around $183, that amounts to a value of over $512 million. This represents an increase of more than 700,000 percent.

Nvidia owes this primarily to the AI boom that has been ongoing for several years.

As a result, the share price has risen from just under $4 in January 2019 to around $183 today, and market capitalization has risen from around $80 billion to over $4.4 trillion in the same period.

Unfathomable wealth

Despite his sale of shares at the time, there is no need to worry about Huang’s finances. His fortune is estimated at approximately $155 to $165 billion.

Find out what Bill Gates now considers to be a mistake with regard to Windows by clicking on the following link:

End customers are feeling the downside of AI due to the extremely high demand for RAM. This has been driving up the cost of not only RAM, but also other components that use RAM, such as graphics cards and SSDs, for months.

There is no end in sight to the crisis; instead, it is likely to continue until at least 2027.